September 15, 2017

From the Federal Student Aid Office

If you are a student or a federal student loan borrower who has been impacted by a federally declared natural disaster, we can help answer your questions.

We are committed to assisting students enrolled in college or career school and federal student loan borrowers who have been impacted by federally declared natural disasters. We strongly encourage impacted students to contact the financial aid office at their school and borrowers to contact their lender or loan servicer.

Below, we have provided answers to frequently asked questions for

You also can see additional resources.

For Current Students

What if I need to transfer to a different school?

If you wish to transfer to a different school, you should contact the financial aid office at your new school as soon as possible so that the new school can request your federal financial aid records. This early contact will also allow the new school to provide you with information needed to support a request for financial aid.

What are my options if my aid eligibility was impacted by a natural disaster but my application does not reflect this change?

The financial aid office at your college or career school is authorized to use professional judgment in order to more accurately reflect the financial needof students and families affected by a disaster. If you feel that your eligibility for aid was impacted by the disaster, you should contact the financial aid office at your school to ask for a reassessment of eligibility.

What if documentation that I need to apply for financial aid has been damaged or lost by a natural disaster?

It is possible that you may be asked to provide documentation to verify information from your financial aid application. If the documentation being requested has been lost or destroyed by the disaster, you should immediately inform the school that asked for the records. That school may make a determination not to require those documents.

Do I need to claim on my FAFSA® form any disaster-related support I received from either the state or the U.S. Department of Education?

No. If you received any special aid from the federal government or from your state, for the purpose of providing financial relief, it should not be counted as income, other resources, or other financial assistance when determining your eligibility for federal student aid.

For Borrowers

If you were impacted by a natural disaster and are having trouble making payments on your federal student loans or have other questions about your loans, here’s some information and a Q&A designed for you:

- The federal loan servicing team checks the Federal Emergency Management Agency website at least once each business day to identify all impacted areas connected to the disaster declaration.

- After a natural disaster, the loan servicing team quickly reaches out to borrowers that live in the impacted areas to notify them of the options available to them; loan servicers also post information on their websites regarding options.

I was impacted by a recent natural disaster. As a result, I am having trouble making payments on my federal student loan. What are my options?

If you are a borrower in repayment who was affected by a natural disaster in the area where you live or work, you qualify for administrative forbearance of loan repayment for a period of up to 90 days upon your request to your servicer. During forbearance, payments are temporarily postponed or reduced. Your servicer will document your loan account with the reason and the length of the forbearance.

Please note that interest still accrues (accumulates) during the forbearance period, but the accrued interest will not be capitalized (added to the principal loan balance) when the administrative forbearance ends. You should contact your loan servicer to request this forbearance.

Once the initial administrative forbearance period related to the disaster is over, you may request additional forbearance time for reasonable cause. Your servicer is permitted to grant additional administrative forbearance time, in 30-day increments, but your total period of forbearance cannot exceed a maximum of 12 monthly billing cycles from the date of the disaster.

I’m behind on my federal student loan payments. Can I get a forbearance?

If a borrower is delinquent, the servicers have been instructed to apply an administrative forbearance for 30 days into the future as well as cover any past delinquency. However, at the end of the forbearance (or consecutive periods of forbearance), any interest for the period of delinquency would capitalize.

I need to provide documentation to my loan servicer, and the due date for the documentation is coming up soon. Can I get an extension of the deadline?

For purposes of certain documentation that a borrower must submit within a specified timeframe (for example, annual documentation of income for the income-driven repayment plans), the federal loan servicers have been instructed to extend the deadline for providing the documentation by an additional 15 days for borrowers who live in an impacted area. Documentation submitted within that revised deadline would be considered to be on time.

In addition, TEACH Grant certification documentation deadlines and timelines for conversion of TEACH Grants to loans will be extended for 15 days.

I’m in the Public Service Loan Forgiveness (PSLF) Program and am concerned that I’m going to miss my payment due date because I was affected by a recent natural disaster. Can I get an extension of my due date?

If you make a PSLF payment more than 15 days after the payment due date, but within 20 days of the due date, your servicer will count that payment as an on-time payment for purposes of the PSLF program if the payment is made during the 30-day period following the date on which a federally declared major disaster was declared.

Note: You will not receive credit for a PSLF qualifying payment if you request and receive a disaster forbearance (or any other deferment or forbearance) during the 30-day period or make a payment more than 20 days after the due date.

My federal student loan is in default. What are my options?

Upon request from a borrower, borrower’s relative, or any other responsible party, we will suspend collections of a defaulted loan for 90 days. The suspension will include suspension of involuntary payments such as administrative wage garnishment and Treasury offset.

If you are making payments toward rehabilitation of a defaulted loan, you will be allowed to stop making payments for those 90 days. At the end of the 90 days, you will either be able to

- pick up where you left off (e.g., if you had made six payments toward rehabilitation before the hurricane, you could make three more to complete the rehabilitation process) OR

- make up your missed payments in one lump sum in order to rehabilitate by your original planned date.

I have a federal student loan and I was not able to complete my school year due to a natural disaster. What are my options?

If you are a federal student loan borrower who was not able to complete your school year as a result of the disaster, you will be provided with an extended “in-school” status until you officially withdraw or re-enroll in the next regular enrollment period, whichever is earlier. This action will prevent you from entering repayment status on your loans. Contact your school to request this action.

Additional Resources

Here are some additional resources that may be helpful to you.

Resources for Those Affected by Natural Disasters:

- Disaster Information for Schools

- Federal Emergency Management Agency (FEMA)

- DisasterAssistance.gov

- American Red Cross

- The National Hurricane Center

If you have additional questions, please contact us.

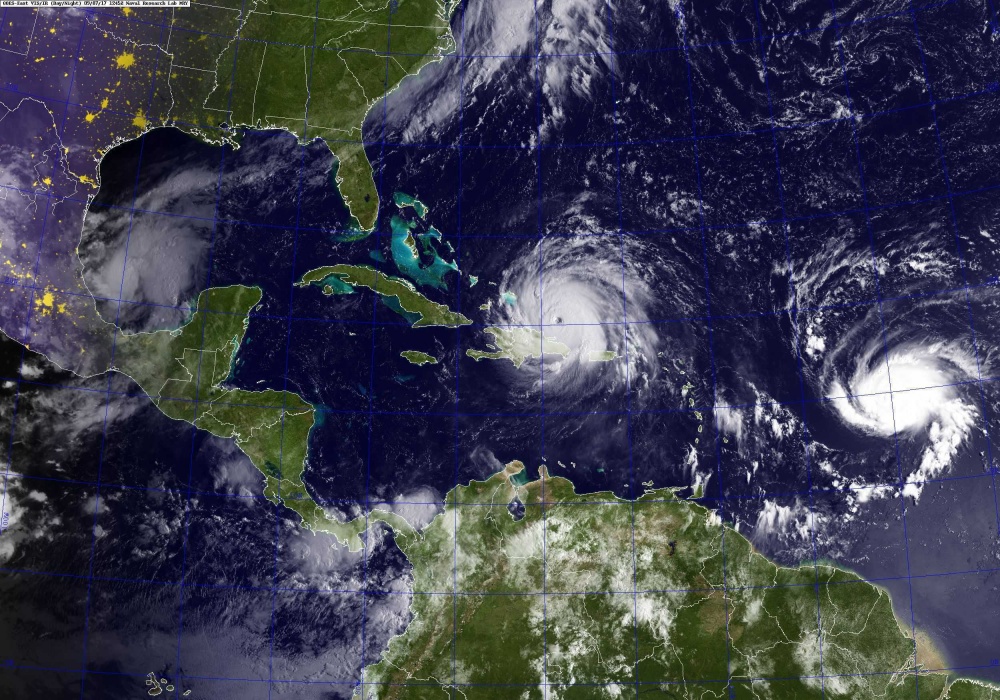

Resources for Those Affected by Hurricane Harvey:

- Information for college or career school students

- Information for federal student loan borrowers

- Federal Emergency Management Agency (FEMA) Information on Hurricane Harvey

- USA.gov Information on Hurricane Harvey

- DisasterAssistance.gov

- American Red Cross

- The National Hurricane Center

If you have additional questions, please contact us.

Resources for Those Affected by Hurricane Irma:

Information for college or career school students

Information for federal student loan borrowers

Federal Emergency Management Agency (FEMA) Information on Hurricane Irma

USA.gov Information on Hurricane Irma

DisasterAssistance.gov

American Red Cross

The National Hurricane Center

If you have additional questions, please contact us.